Hashish Concentrates are loads just like the orange juice focus in your fridge—each are the outcomes of extracting the perfect components of the plant to yield even larger efficiency. Within the case of hashish, cannabinoids (THC particularly) usually are prioritized for top efficiency. From the easy use of strain and warmth to create rosin to the extra subtle solvent-based extraction course of for distillates, there are a selection of how concentrates will be produced. Completely different extraction strategies create totally different consistencies as effectively, starting from glass-like “shatter” to thick, icing-like “budder.”

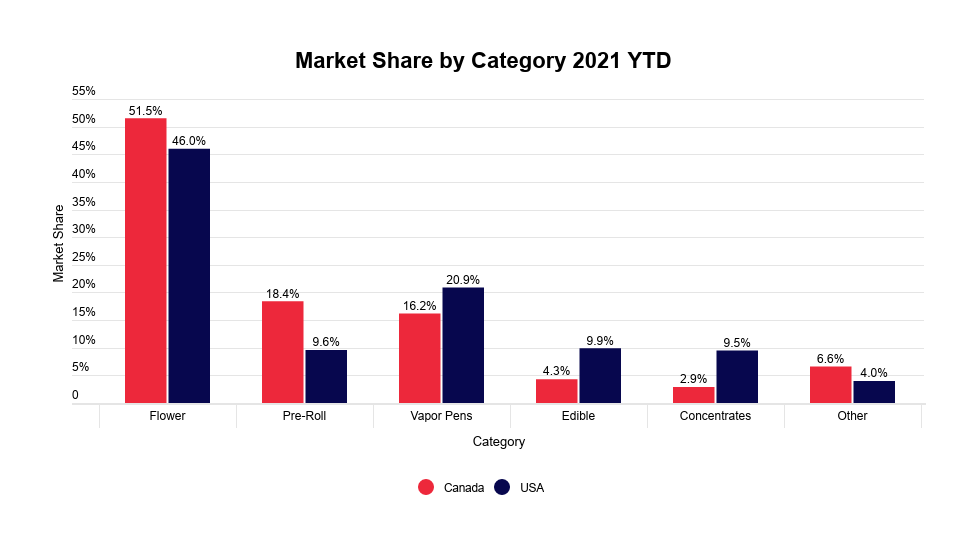

The focus class is essential in each the USA and Canada, however shopper shopping for preferences throughout the concentrates class fluctuate drastically. First, concentrates maintain extra of the market within the U.S. than in Canada. Within the U.S., concentrates account for 9.5 p.c of complete hashish gross sales — 6.6 p.c extra market share than in Canada, the place the class has solely 2.9 p.c of the market.

Inside the concentrates class, hash is extra in style in Canada with 26 p.c market share; dwell resin leads within the U.S. with 33 p.c of gross sales throughout the class. By way of packaging, shoppers within the U.S. want a one-gram package deal measurement, which accounts for 96 p.c of items offered — considerably larger than Canada’s 71 p.c. As for strains, 17.9 p.c of Canadian shoppers say their favourite straing is “indica-only” whereas GG#4 holds the highest spot within the U.S., although with only one.4% market share.

All gross sales, market share, unit quantity, pricing, and demographic knowledge for this report are sourced instantly from Headset Insights. Graphs labeled “2021 YTD” cowl the interval between January 1 and June 30, 2021.

Market share of hashish classes by nation

Once we deal with concentrates from January by means of June 2021, we see the U.S. prefers concentrates way more than Canada, boasting 6.6 p.c larger market share. In each nations, concentrates land within the fifth-most-popular-spot, solely 0.4 p.c behind edibles and effectively behind flower, the dominant class. Flower’s market share has fallen in Canada since “hashish 2.0” merchandise rolled out, now holding 51.5 p.c of the market, whereas vapor pens, edibles, and concentrates are gaining traction.

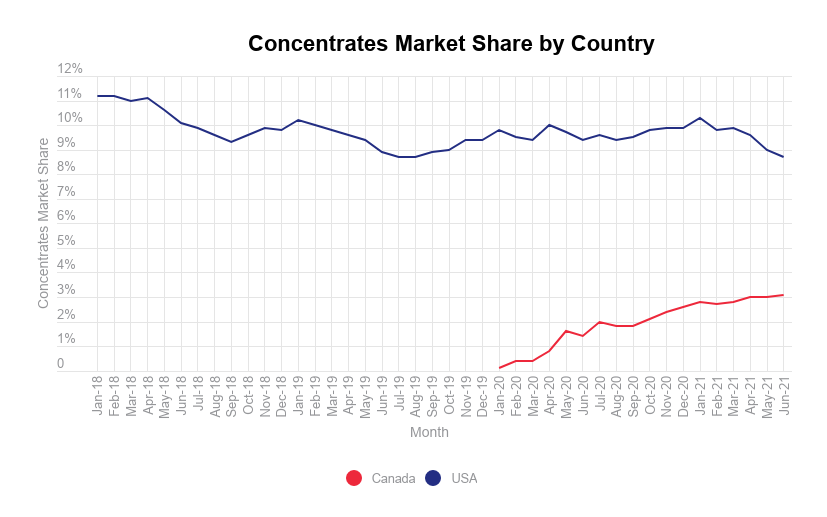

Market share of hashish concentrates by nation

Although declining within the third quarter of 2021, the concentrates market within the U.S. continues to have a larger share than Canada, by greater than a 5-percent margin. After the discharge of hashish 2.0 classes, concentrates market share in Canada grew shortly and continues to pattern upwards, gaining roughly 3 p.c prior to now eighteen months.

Market share of concentrates by state and province

It is very important keep in mind there are vital variations between hashish legal guidelines and laws within the U.S. and Canada when evaluating concentrates market share throughout states and provinces. For instance, Pennsylvania regulation prohibits some classes, together with pre-rolls, since smoking hashish flower stays unlawful within the state; flower could also be consumed solely by way of vaporization. So, unsurprisingly, Pennsylvania leads the focus market due to its distinctive, medical-only consumption laws that result in elevated vaporization use.

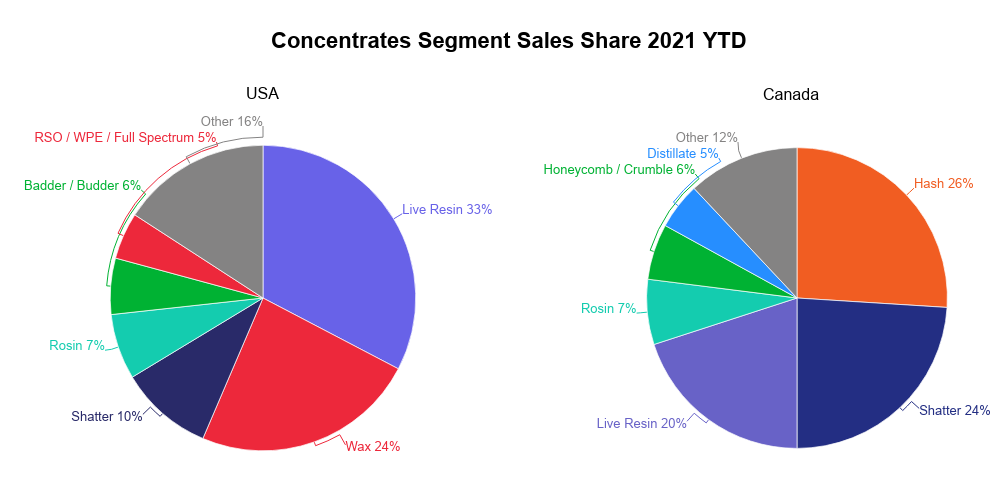

Gross sales share of focus segments by nation

When breaking down the gross sales share of concentrates by nation by means of June 2021, dwell resin and wax dominated the U.S. market with 33 p.c and 24 p.c share, respectively. Hash stayed on the high in Canada at 26 p.c, adopted by shatter at 24 p.c. This graph illustrates the clear distinction in choice in every nation, as shatter is a high performer in Canada however holds solely 14 p.c of the market within the U.S.

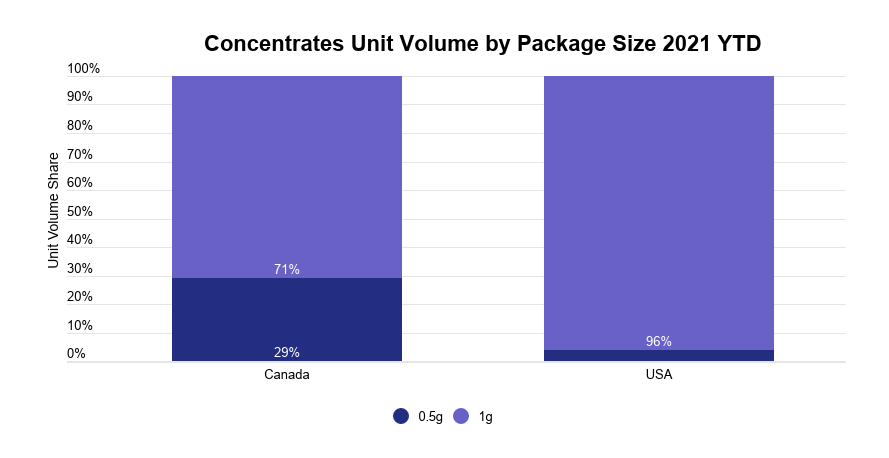

Package deal sizes by nation

Package deal measurement preferences in every nation present a stark distinction: The U.S. clearly prefers a one-gram measurement versus a half gram, with the previous holding 96 p.c of the market. It is a little more break up in Canada, the place 29 p.c of the market share goes to half-gram packages.

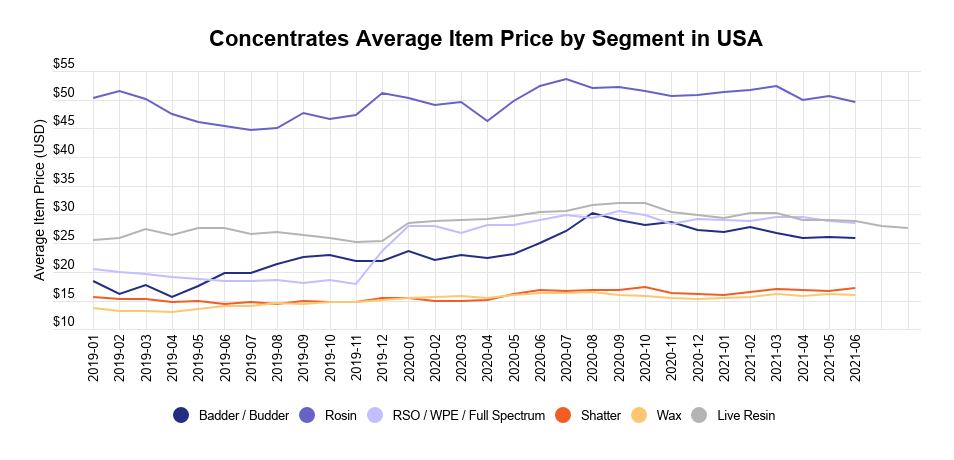

Common worth by phase within the U.S.

Focus costs have a tendency to remain under the $35 mark within the U.S. Standard classes like dwell resin, shatter and wax have remained constant in pricing, whereas segments like Rick Simpson oil and related preparations jumped from $20 to $30 in 2020. Rosin confirmed the best common costs (greater than $50) regardless of holding solely 7 p.c of the market, indicating shoppers could also be prepared to pay further for a solventless product.

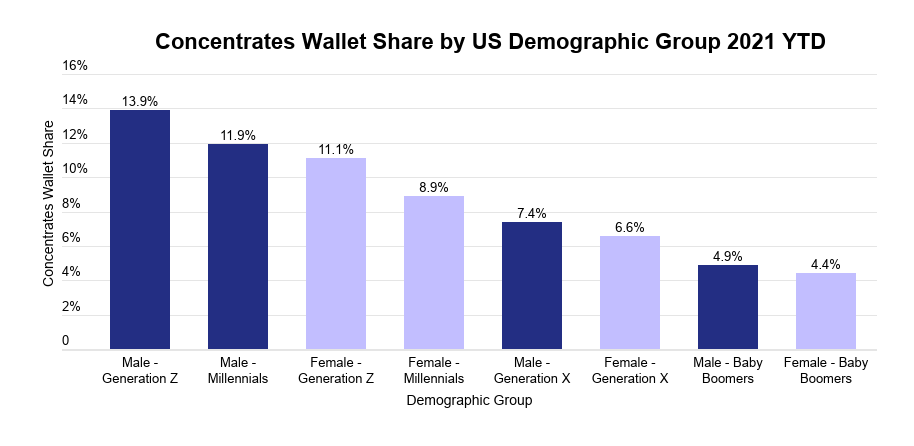

Pockets share by demographic group within the U.S.

Gen Z males have confirmed to be the highest shoppers of concentrates, contributing 14 p.c of complete gross sales to the class. Male millennials observe shut behind with 11.9 p.c of pockets share for concentrates.

On this class, it’s clear the older the demographic, the smaller the pockets share. Child Boomer, who contribute simply 5 p.c to the class’s gross sales. Whatever the age group, male shoppers constantly have the next pockets share for concentrates than their feminine counterparts.

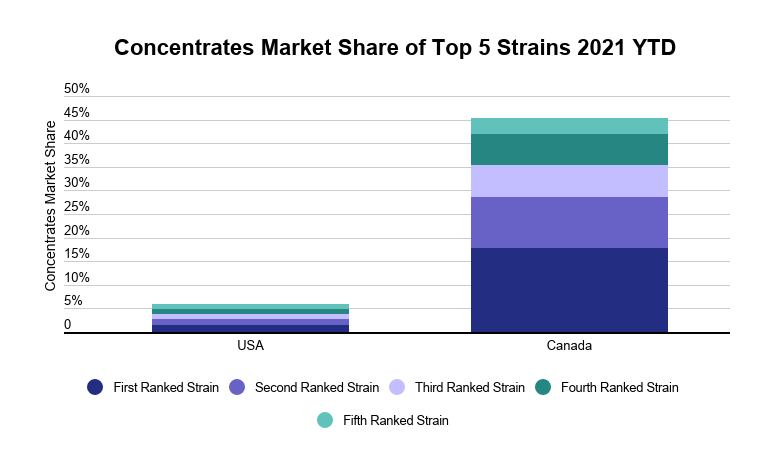

Market share of high focus pressure by nation

On this graph, it’s value noting the U.S. hashish market sells considerably extra strains than Canada, leading to decrease market shares per pressure. “Indica-only,” Canada’s high pressure, holds 17.9 p.c of the market, in comparison with the U.S. high vendor GG#4 at 1.4 p.c.

Conclusion

Whereas hashish concentrates could also be a smaller class, it’s distinctive and price keeping track of throughout the U.S. and Canadian markets.

Key Takeaways

- Concentrates are extra in style within the U.S. than in Canada, with a 6.6 p.c larger market share to concentrates: The US has a 9.5-percent market share; Canada’s is 2.9 p.c.

- U.S. and Canadian shoppers have totally different preferences by way of concentrates segments. Hash is the highest vendor in Canada, whereas dwell resin has the highest spot within the U.S.

- Choice varies by age. The older the demographic, the decrease their pockets share to concentrates. Male clients purchase greater than feminine clients.

Cy Scott is co-founder and chief govt officer at Headset Inc., turning retail knowledge into real-time hashish market insights. He gives business evaluation and insights about revolutionary manufacturers by means of his weekly weblog, Cannabis Packaged Goods. Previous to founding Headset, he co-founded Leafly and helped develop the positioning into the world’s main hashish info useful resource. Alongside along with his work at Headset, Scott based a month-to-month Hashish Tech Meetup internet hosting hashish entrepreneurs and expertise builders that has expanded into a number of areas all through the U.S. Scott’s favourite pressure is Tangie.

if ( window.fbAsyncInit === undefined ) {

window.fbAsyncInit = function() { FB.init({ appId : '228081358088776', xfbml : true, // version : 'v2.7' version : 'v9.0' }); };

(function(d, s, id){ var js, fjs = d.getElementsByTagName(s)[0]; if (d.getElementById(id)) {return;} js = d.createElement(s); js.id = id; js.src="https://connect.facebook.net/en_US/sdk.js"; fjs.parentNode.insertBefore(js, fjs); }(document, 'script', 'facebook-jssdk'));

}