Vertigo3d/E+ through Getty Photographs

Written by Nick Ackerman

Progressive Industrial Properties (IIPR) is not simply your on a regular basis industrial properties REIT corresponding to STAG Industrial (STAG), which we additionally personal. This REIT is in a specialised class of the warehouse and distributions heart enterprise. They describe themselves because the “main supplier of actual property capital for the medical-use hashish trade.”

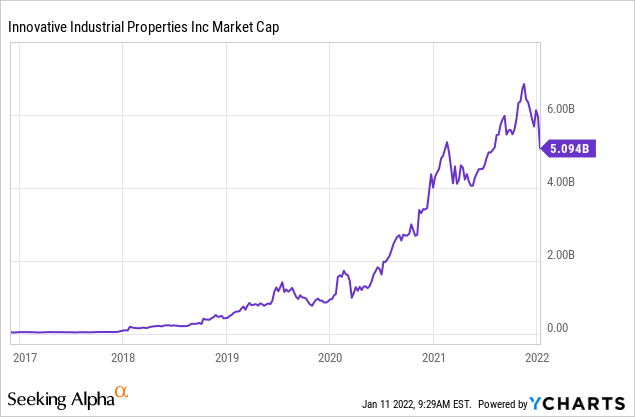

This has positioned IIPR to be in a league of its personal. For traders, the REIT branches into all the principle investing classes of development, earnings, dividend development, and hypothesis. Usually, REITs are generally related to earnings performs. The hypothesis half needs to be significantly highlighted because it is not your on a regular basis well-established REIT that has been offering traders returns for many years. They got here to the investing scene in 2016.

Progress, Dividend, and Hypothesis

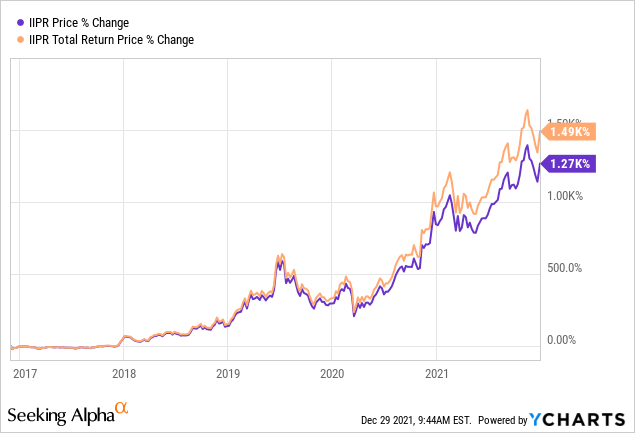

That being stated, that hypothesis half is exactly why we have seen the returns that we have skilled to date. Beneath is a chart for the reason that REIT’s launch on each a complete return and worth foundation. The full return, in fact, factoring within the dividends they’ve paid. When returns are this spectacular, it usually will get investor consideration.

Ycharts Ycharts

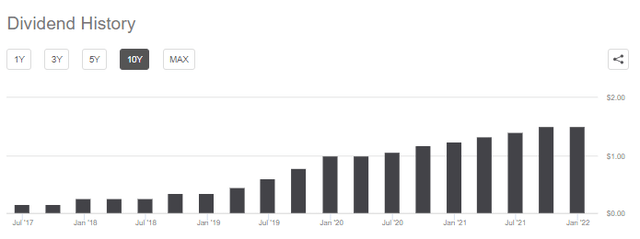

These dividends have been fairly substantial too. Nonetheless, that development may take a little bit longer to attain, as they announced more recently that they might consider within the first and third quarters. Beforehand, that they had been asserting dividend will increase nearly each quarter.

Paid a quarterly dividend of $1.50 per share on October 15, 2021 to frequent stockholders of document as of September 30, 2021, representing an roughly 28% improve over the third quarter 2020’s dividend. As beforehand introduced, going ahead as a normal matter, IIP’s board of administrators expects to judge changes to the extent of IIP’s quarterly frequent inventory dividend each six months, with any changes anticipated to be declared within the first quarter and third quarter of every yr.

Yet another signal that the REIT is maturing, at the least a little bit bit.

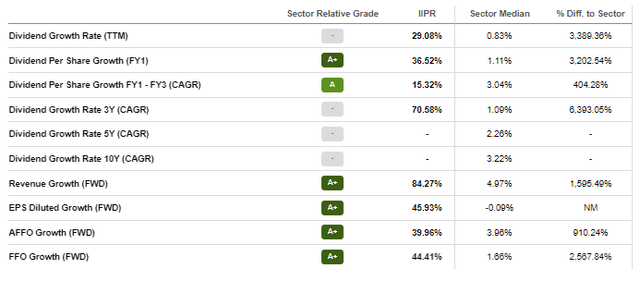

They continue to be dedicated to maintaining the payout ratio between 75% and 85% of AFFO, as they famous of their Q2 earnings call. That has resulted in an exceptional development trajectory, fueled by the speedy development within the REIT itself.

As we have indicated up to now, the Board continues to focus on a dividend payout ratio of 75% to 85% of AFFO on a stabilized portfolio foundation.

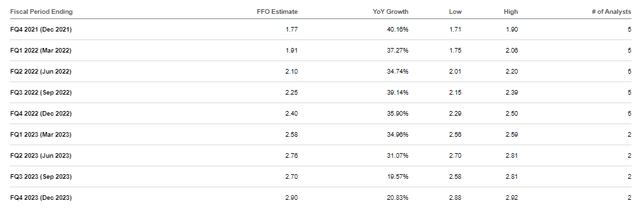

After they introduced their Q3 earnings results in early November, we noticed AFFO got here in at $1.71. For the final 9 months, AFFO got here to $4.81. Analysts have been anticipating development within the identify to proceed at a speedy clip. Actually far more of a brisk tempo than the remainder of the REITs in my portfolio.

Analysts anticipate that IIPR will ship $8.66 FFO subsequent yr, anticipating that they are going to present $6.34 this yr. That can symbolize development of almost 37% if they supply what is predicted in This fall to complete off their fiscal yr. Progress like that might imply we additionally see a couple of 37% improve within the dividend too.

As stunning as which may appear, that’s gradual in comparison with what we have been getting if we have a look at the compounded annual development price during the last three years. Sadly, we do not have an extended observe document, however what we do have is sort of spectacular. The shortage of a observe document is what suits into the speculative a part of the equation as nicely.

They initiated a $0.15 quarterly dividend after they initially launched and the newest coming to $1.50 means development of 900%. This hasn’t been sufficient to maintain up with their share worth development, however I might say it’s fairly spectacular nonetheless. At the moment, the REIT is yielding 2.82%, so we’re nonetheless trying higher than the S&P 500 by a substantial quantity.

Fueling this development has been the truth that it was a small operation to start out with. While you add 10 properties however solely have 10 to start out with – that is doubling your measurement. If you’re Realty Revenue (O), it’s a must to make vital acquisitions to get your needle shifting. That is precisely what they did after they merged with VEREIT. The combined entity has almost 11k properties. That was up from the roughly 6700 properties pre-merger. That is an excessive instance, however hopefully, the purpose is evident.

IIPR had simply 76 properties in whole on the finish of Q3 2021. Since then, they have been persevering with to purchase properties to develop, simply as any good REIT ought to. That is how they generate appreciation and development for his or her shareholders. A recent deal closed a very massive 27 properties, bringing whole properties to 103 now throughout 19 states.

Not solely does it make sense that they need to proceed to amass properties, however we now have to know that these properties are additionally being occupied. Within the case of IIPR, they noted that 100% of their 7.5 million rentable sq. toes was at present leased. Much more spectacular, they famous that the weighted-average remaining lease time period was 16.7 years. That ought to present constant earnings from their tenants for years to come back.

Dangers

Whereas all that’s spectacular, it is not to say that IIPR comes with out dangers. There are dangers right here which can be fairly explicit to this particular enterprise – in addition to the final hazards that we might anticipate in any funding.

The very fact is, they nonetheless have fairly an enormous runway to proceed to develop at a wholesome clip. They don’t seem to be a big REIT by any means, with simply 103 properties now. Nonetheless, as talked about above, when you’ve gotten 10 properties and purchase 10 extra, you are doubling.

At this level, when IIPR provides ten properties, we now have below a ten% improve. It is fairly spectacular contemplating the extra established REITs on the market, however regardless, as they develop, they’re maturing, which suggests development turns into slower. By way of market cap, they’ve hit the mid-cap degree. 2020 was after they made the transition from small to mid.

To not point out, the valuation of the REIT right here is on the upper finish, regardless of the newest declines. P/FFO involves 33.60, which implies that a whole lot of development is already being priced in. Even when they hit their FFO estimates, we’re taking a look at a P/FFO round 30, which remains to be fairly lofty. In the event that they miss, which has been uncommon, the valuation can come down in a fast hurry.

The monetary power of the underlying tenants also needs to be known as into query. One of many causes they are not constructing their very own amenities is as a result of they lack the capital – and the entry to capital that we’ll contact on in a bit. With medical marijuana being a more recent trade general (at the least one that’s changing into far more extensively accepted), there is not a long-term historical past for many of those operators. With an trade that’s up-and-coming, there are issues right here. As they famous with their latest quarterly report:

The properties that we purchase encompass actual property belongings that help the regulated hashish trade. Modifications in federal regulation and present favorable state or native legal guidelines within the hashish trade could impair our skill to resume or re-lease properties and the flexibility of our tenants to satisfy their lease obligations and will materially and adversely have an effect on our skill to keep up or improve rental charges for our properties.

Lastly, one final predominant concern that’s particular to this REIT. For these conversant in IIPR already, this would possibly not be information. Nonetheless, for many who could also be contemplating a place, a big danger is that if, on the federal degree, marijuana is legalized. The explanation for it is because they’re having fun with excessive hire costs that they’ll cost to tenants.

If it turns into legalized, which means a flood of {dollars} and competitors can shortly transfer into the area. To not point out that the tenants themselves may go get their very own financing by way of the massive banks that have not or cannot present funding for such initiatives. That may minimize out leasing, however a big sufficient operation most likely would not see this as a very enticing route.

A little bit of a counterpoint to that danger is the truth that they solely function in 19 states right now. That may additionally open up extra avenues for them to diversify extra geographically, relatively than being located in friendlier states with comparatively extra relaxed marijuana legal guidelines.

Conclusion

IIPR is certainly not for everybody as a result of speculative nature of the identify. That being stated, if you happen to can deal with extra danger, it offers a fairly enticing place to place capital to work. An investor can get development, earnings, and dividend development on this REIT. That’s if they’ll proceed to execute as efficiently as they’ve performed since 2016.

This is likely one of the greatest performers in my portfolio. The huge run-up within the worth has put it on the costly facet, with development being spectacular however a whole lot of it already being priced in. Admittedly, each time I have a look at it too, I inform myself that it’s too costly – then it appears to run even increased. The most recent pullback may very well be creating a chance.