Many high development shares have been falling considerably over the previous a number of months. And for traders who’re keen to hold on for the lengthy haul, there may be some extremely enticing shopping for alternatives on the market.

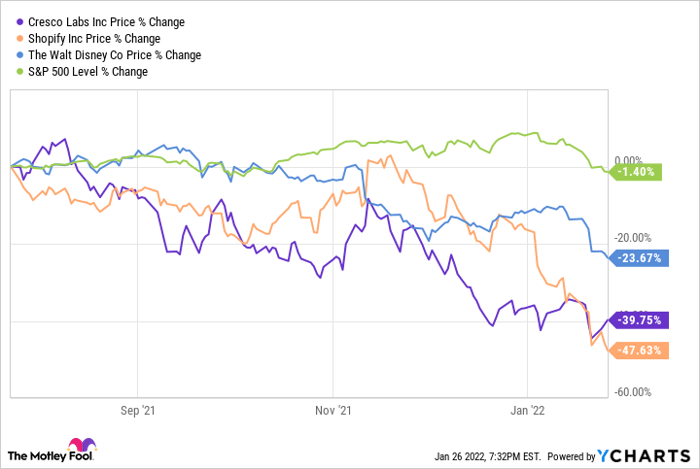

Three shares which have fallen greater than 20% previously six months however have robust companies are Cresco Labs (OTC: CRLBF), Shopify (NYSE: SHOP), and Walt Disney (NYSE: DIS). Though these declines may look regarding, shopping for these shares now might repay within the years forward.

CRLBF knowledge by YCharts.

1. Cresco Labs

Legalization may not be coming to the U.S. marijuana business anytime quickly as President Joe Biden has not proven a lot curiosity within the problem. However that does not imply the sector is not ripe for development; hashish analysis agency BDSA initiatives that the worldwide marijuana market will develop at a compound annual fee of twenty-two% and be price greater than $47 billion by 2025.

One firm that may be a key a part of that development is multi-state operator Cresco Labs. The Chicago-based pot producer has been rising whereas constantly producing robust margins. In its most up-to-date quarter, for the interval ending Sept. 30, 2021, adjusted earnings earlier than curiosity, taxes, depreciation and amortization (EBITDA) totaled $56.4 million and was greater than 26% of income, which got here in at $215.5 million. Only a 12 months in the past, the corporate’s high line was $153.3 million. And for the fourth quarter, Cresco expects to proceed to see that income quantity climb sequentially to between $235 million and $245 million.

By means of acquisitions in a number of markets, together with Pennsylvania, Massachusetts, and Ohio, Cresco is steadily rising its presence and capitalizing on extra alternatives. Buying and selling at a price-to-sales a number of of simply over 2, it is also extremely low-cost in comparison with hashish large Curaleaf Holdings, which traders are paying greater than 4 instances income for.

Cresco is an thrilling development inventory that might be a steal of a deal at its present share worth.

Picture supply: Getty Photographs.

2. Shopify

The pandemic has given customers additional motivation to purchase items on-line, whether or not it is out of security issues or as a result of distributors merely supply more-convenient pickup and supply choices. And almost two years into the COVID-19 disaster, there continues to be robust development within the sector.

Through the Black Friday and Cyber Monday weekend of 2021, there was $6.3 billion spent on Shopify’s e-commerce platform, representing a year-over-year improve of 23%, and greater than doubling 2019’s tally.

Spectacular development is not new for Shopify, because the enterprise has grown from income of $389 million in 2016 to greater than $2.9 billion in 2020. Within the trailing 12 months, its gross sales have risen to greater than $4.2 billion.

And there is nonetheless no purpose to anticipate the expansion to cease. In January, the corporate introduced a partnership with JD.com, a Chinese language e-commerce web site, which is able to make it simpler for Chinese language firms to promote to Western markets by Shopify’s platform.

Shopify is buying and selling at ranges not seen since mid-2020. At this time, its enterprise is way safer than in years previous, recording each constant income and optimistic free money stream. For those who’re ready for the inventory to drop a lot decrease, you may miss a golden alternative to safe this high development inventory at an ideal worth.

Picture supply: Getty Photographs.

3. Walt Disney

Buyers have been lukewarm about Walt Disney after the corporate’s fourth-quarter earnings report in November 2021 didn’t impress. Not solely did earnings per share miss the mark ($0.37 on an adjusted foundation versus estimates of $0.51), however the firm additionally warned that subscriber development for Disney+ might be a problem. For the interval ending Oct. 2, 2021, the corporate added simply 2.1 million subscribers from the earlier quarter whereas analysts had been anticipating 9.4 million.

However Disney is not the one streaming firm fighting rising its subscriber numbers; rival Netflix also disappointed shareholders in its latest earnings report. With so many streaming providers on the market along with Disney+ and Netflix (like HBO Max and Peacock), the competitors for subscribers is fierce, particularly with inflation making it more durable for shoppers to juggle all of them.

Nonetheless, Disney is thought for its high quality content material and is not an organization I might wager towards on this enviornment. And it nonetheless is not working at the place it is going to be as soon as COVID is not hampering its theme parks. For the previous fiscal 12 months, income from its parks, experiences, and merchandise section totaled $16.6 billion. Two years in the past, that quantity was up over $26 billion.

Disney will probably be an enormous winner from a return to regular within the financial system. And even when its streaming numbers could not expertise vital development, there are nonetheless loads of alternatives in different areas of its enterprise. Buying and selling close to its 52-week low and at a ahead price-to-earnings ratio of 33 — much like Netflix (which is not almost as numerous of a enterprise) — Disney’s inventory is certainly probably the greatest bargains on the market proper now for development traders.

Here is The Marijuana Inventory You have Been Ready For

A little bit-known Canadian firm simply unlocked what some specialists suppose might be the important thing to profiting off the approaching marijuana increase.

And make no mistake – it’s coming.

Hashish legalization is sweeping over North America – 15 states plus Washington, D.C., have all legalized leisure marijuana over the previous couple of years, and full legalization got here to Canada in October 2018.

And one under-the-radar Canadian firm is poised to blow up from this coming marijuana revolution.

As a result of a game-changing deal simply went down between the Ontario authorities and this powerhouse firm…and it’s worthwhile to hear this story at present when you’ve got even thought of investing in pot shares.

Merely click on right here to get the total story now.

David Jagielski owns Cresco Labs Inc. The Motley Idiot owns and recommends Cresco Labs Inc., JD.com, Netflix, Shopify, and Walt Disney. The Motley Idiot recommends the next choices: lengthy January 2023 $1,140 calls on Shopify, lengthy January 2024 $145 calls on Walt Disney, brief January 2023 $1,160 calls on Shopify, and brief January 2024 $155 calls on Walt Disney. The Motley Idiot has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the creator and don’t essentially replicate these of Nasdaq, Inc.