Aleksandr_Kravtsov/iStock by way of Getty Pictures

Not too long ago, Trulieve Hashish (OTCQX:TCNNF) wasn’t an interesting hashish inventory to personal because of its reliance on the instantly aggressive Florida market. The Harvest Well being & Recreation deal plus successful to the inventory value has solved plenty of the prior lack of curiosity within the inventory. My investment thesis is now way more Bullish on Trulieve Hashish transferring ahead because of the sector weak point.

Diversification

Regardless of some minor strikes into different states, Trulieve Hashish entered 2021 with the overwhelming majority of revenues from the Florida market. Earlier than closing the Harvest Recreation deal on October 1, the MSO (multi-state operator) had 91 out of 101 operational shops within the Sunshine state.

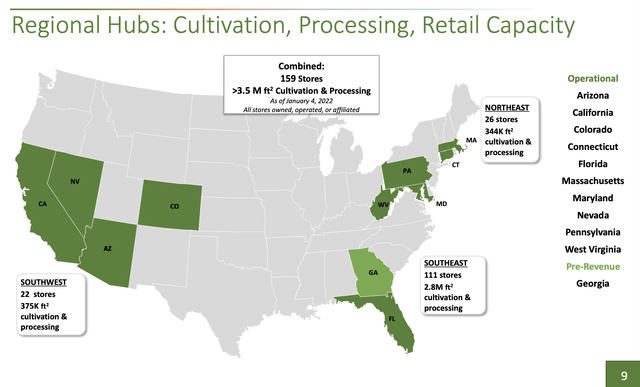

Harvest Well being added over 40 dispensaries with a main give attention to the leisure hashish market in Arizona together with the medical hashish market in Pennsylvania. Trulieve Hashish now has 159 shops open with 111 shops in Florida now because of opening new shops within the state plus the 14 extra areas of Harvest Well being.

The hashish MSO hasn’t eradicated their reliance on the medical hashish market in Florida, however Trulieve Hashish now has regional hubs within the Northeast and Southwest to supply a stage of diversification. Each areas wrestle to match the dimensions of Florida with an estimated annual gross sales price topping $750 million now because of 111 medical dispensaries within the state with flower gross sales equal to just about half the entire $1+ billion Florida market with gross sales forecast to go to $2 billion by 2025.

In the end although, Trulieve Hashish solely has 17 retail dispensaries in Arizona with the Pennsylvania market having the same 18 medical dispensaries. These two markets solely mixed for 35 shops whiles Florida has 111 shops. Even with the brand new shops added in This fall’21, the MSO added 7 areas in Florida with solely 4 shops added in non-Florida markets together with 2 medical dispensaries in West Virginia.

Based mostly on Q3’21 numbers, Harvest Well being added about $368 million in annual revenues on the time the deal closed. The MSO additionally added 50.8 million shares to the enterprise.

Market Regular Mannequin

Previous to the Harvest Well being deal, Trulieve Hashish wasn’t way more than a single-state operator in Florida. The give attention to one sturdy state lead the MSO to have business main margins topping 50% at one level and coming in at 43.7% in Q3’21.

Harvest Well being was way more diversified and together with Trulieve Hashish increasing into different states. The corporate guided to mixed Q3’21 revenues of $316 million with adjusted EBITDA of simply $121 million.

The Arizona centered MSO added $96 million in quarterly revenues with adjusted EBITDA of solely $23 million. Harvest Well being solely had EBITDA margins of 24% main the mixed firm to have adjusted EBITDA margins down at 38%.

Trulieve Hashish is now extra derisked as traders aren’t frightened about paying up for an irrational view on the productiveness of the administration crew. Additionally, traders can worth the inventory primarily based progress going ahead with much less threat of giving again EBITDA.

The corporate has ~180 million shares excellent and now trades with a market valuation of simply $3.6 billion. Based mostly on a run price adjusted EBITDA within the $500 million vary, Trulieve Hashish solely trades at ~7x EBITDA.

With EBITDA margins extra consistent with the market now, traders aren’t as frightened about shopping for the inventory into declining margins. The largest fear remains to be the aggressive place in Florida.

Based on the newest OMMU data for the week of January 28, Trulieve Hashish solely controls barely above 25% of the medical dispensaries in Florida whereas controlling ~50% of the flower gross sales. Smaller MSOs similar to Ayr Wellness (OTCQX:AYRWF) and Purple White & Bloom (OTCQX:RWBYF) are nicely documented as having purchased licenses within the state missing cultivation provides to successfully run shops. These smaller MSOs are shortly ramping up cultivation and opening new shops.

Trulieve Hashish nonetheless faces a situation have been logical market share losses in Florida might reduce progress charges for years. If the MSO cannot develop in Florida, the opposite states will not have the ability to choose up a lot slack at someplace round 30% of the enterprise.

Takeaway

The important thing investor takeaway is that Trulieve Hashish is now a worth play with lowered threat from diversifying away from the upper margins of the Florida market. The corporate is now aggressively investing in rising gross sales exterior Florida resulting in lowered adjusted EBITDA margins. The MSO nonetheless faces the danger of dropping market share in Florida, however the inventory is simply far too low cost right here buying and selling at solely 6.5x 2022 EBITDA targets of round $550 million.