taseffski/E+ through Getty Photos

The potential development of the hashish trade has captured the hearts of buyers in every single place. Hashish shares have pulled again considerably over the past 12 months or so, which brought about some shareholders’ heartburn. With so many questions surrounding regulation, provide and demand, and failures in Canada’s hashish shares, some people have extra questions than solutions. Glass Home Manufacturers (OTC:GLASF) has positioned itself to keep away from most of the dangers which have plagued different hashish corporations and have created a sustainable price benefit in cultivation, which ought to put investor’s minds relaxed.

Funding Thesis

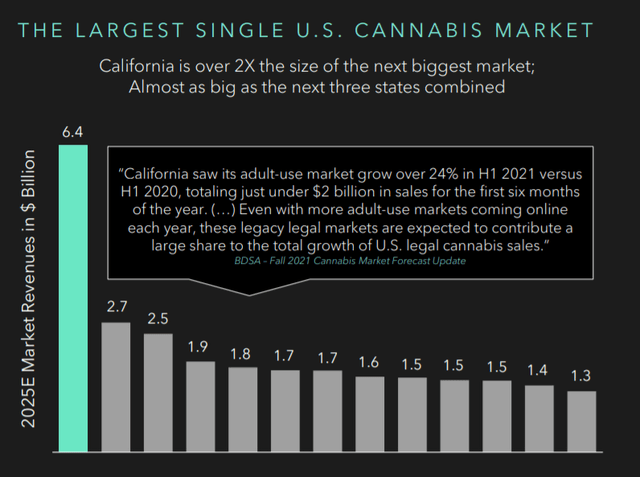

Glass Home Manufacturers is a superstate hashish operator in California, and so they need to hold it that method for a number of causes. The California hashish scene has been on the forefront of the trade because it originated in San Francisco’s Haight-Asbury district. The underground enterprise has been evolving and growing for many years. Now, these people are bringing that tradition mainstream. A few of them are working for Glass Home. Although, the primary attraction is that California is large.

Cities and municipalities throughout California have been quickly approving dispensaries throughout 2021. At the least 92 retail licenses will likely be awarded after November 2021 poll measures. Most of these licenses coming on-line in 2022. Glass Home will stand by to fill their cabinets over the following 12 months.

In September final 12 months, Glass Home closed on one of many largest greenhouses within the U.S. Positioned in Ventura County (SoCal facility). The SoCal facility consists of six greenhouses totaling 5.5 million sq. ft. The corporate bought the greenhouse from a tomato grower for round $157 million in money and inventory. An enormous tablet to swallow for a smaller firm, however an important alternative (see this video relating to the SoCal facility).

Why does this matter? Value benefit

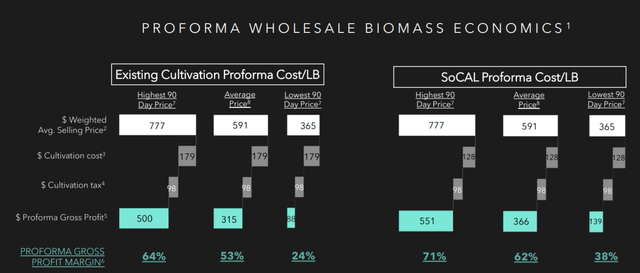

Being in Ventura County alone offers the greenhouse important pure price benefits. The perfect temperature for hashish to develop is 65 to 85 levels. Very conducive to the constant temperature vary within the space. Common daylight in Southern California is over 12 hours per day. Greenhouses in numerous areas throughout California and the remainder of the U.S. have further prices to regulate heating and cooling, lighting, and humidity that Glass Home greenhouses get naturally.

Maybe essentially the most important price benefit is that they personal the greenhouses. Most different cultivators lease their greenhouses. As a result of the hashish trade continues to be unlawful on the federal stage and has a detrimental (though diminishing) stigma, greenhouse rents are effectively above common.

Altogether, Glass Home can at the moment produce a pound of hashish for about $180. Administration believes they’ll get near $100 per pound at full scale. The common price for smaller farmers in Californian is nearer to $500 per pound.

These price benefits will change into exponentially vital if/when hashish turns into federally authorized and cultivators throughout the U.S. compete throughout state borders. At the moment, cultivators with greater price buildings that develop in a number of states might have points producing margins and will find yourself restructuring. That situation would give Glass Home a dominant place within the wholesale hashish market within the U.S. This is what CEO Kyle Kazan stated in the course of the Q3 2021 earnings call:

Once you have a look at MSO [multiple state operators], and as an example, you are vertically built-in in 25 states, there isn’t any different trade that has 25 state vertical integration. So, there’s going to be cleanup that each a kind of MSOs are going to must do to drive effectivity or else they will have some actual issues. And so, I’d anticipate that there is going to be some write downs and there is going to be simply cleanup.

Glass Home at the moment operates 4 retail dispensaries positioned in Berkeley, Santa Barbara, Los Angeles, and Santa Ana.

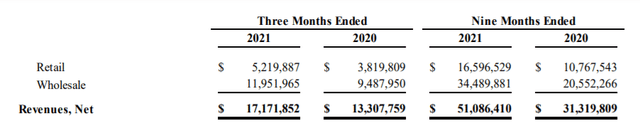

As Glass Home’s retail dispensary base has come on-line over the past years income has elevated dramatically. For the final quarter, retail dispensaries have grown income by over 36%.

Increasing retail in California is a high precedence for the corporate. The apparent benefit is the higher-margin enterprise for the cultivated hashish bought by way of owned dispensaries.

Two extra retail dispensaries in Santa Barbara and one in Dunsmuir, Hesperia, and Eureka will open earlier than mid-year. Glass Home’s income and margins ought to broaden over the following years.

The corporate can also be due 14 extra licenses from its former accomplice, Factor 7. These licenses are being held up in a suit filed in February of 2021. When these licenses probably change into out there to Glass Home, the retail portfolio will nearly triple.

Working from a place of power has helped Glass Home navigate the difficult tax surroundings in California. The state is one among solely two that impose a cultivation tax. This case has been powerful on Glass Home, and smaller grows. Particularly after contemplating that the tax has reset higher starting in 2022. There’s a sturdy chance of aid coming as early as this 12 months. California Governor Gavin Newsom released statements indicating that hashish tax reform will likely be addressed in his 2022-23 funds. His motivation is to stabilize costs available in the market and hasten the illicit market’s transition to present and future licensed California operators. Studying between the traces, a present discount in tax income to the state will promote the enlargement of the authorized hashish market, and tax income grows greater in down the street.

Hashish trade analysts in California consider that the cultivation tax will likely be on the middle of funds discussions. Additionally they consider that the cultivation tax could possibly be eliminated.

The 2022 cultivation tax fee is about $160 per pound. If the tax is eradicated, it might add over $20 million to the corporate’s backside line going ahead. This is able to be a monumental elevate for the corporate’s enlargement plans.

Dangers

Glass Home might undergo if wholesale costs proceed to say no. After a really frothy 12 months in 2020 for hashish, cultivation elevated dramatically in 2021. Dispensary licenses and retailer openings didn’t hold tempo with cultivation. Accordingly, hashish costs hit all-time lows beginning in the summertime of 2021 and stayed depressed all year long. As famous above, retail licensure within the state will doubtless improve considerably in 2022. When new California dispensaries open and cultivation normalizes, hashish costs also needs to normalize to greater ranges. Glass Home’s price benefit is significant to surviving downturns like this.

Glass Home’s plans contain substantial development tasks. Value and time overruns are at all times a danger. In Q3 2021 Glass Home invested near $100 million within the first part of its SoCal greenhouse retrofit. I consider they’ll simply earn an important return on that funding and future investments. If not, the inventory might undergo.

Glass Home turned a public firm by way of a SPAC merger with Mercer Park Acquisition in late 2021. The administration staff selected to go this route as a result of it had an settlement to buy the SoCal facility and wanted a fast turnaround. SPAC shares have typically been given a nasty identify and rightfully so typically. Along with the stigma, unique SPAC buyers have tended to dump their shares after their lock-up durations finish. This isn’t the case with Glass Home. The unique house owners of Glass Home at the moment are on the administration staff and haven’t bought a single share.

Valuation

The market cap for Glass Home inventory is about $250 million. In keeping with their insurance coverage evaluation, the substitute price of the SoCal greenhouse is $250 million. That means, the corporate inventory is on the market for the substitute price of the SoCal greenhouse alone. After you add 4 present dispensaries and 4 extra solely months from coming on-line, you may have an enormous cut price.

Glass Home could have 6 million sq. ft of greenhouse area able to producing round 2 million kilos of hashish per 12 months at full scale. In a bear case, if the common wholesale value shrunk to $300 per pound and remained there, Glass Home might produce at a price lower than $200 per pound. That is round $200 million of gross margin on the wholesale enterprise alone. In actuality, the hashish they promote is on the upper finish of the common wholesale value, which can doubtless improve to a extra regular stage. Even purchase this bear case back-of-the-envelope valuation, the shares are engaging.

A extra doubtless base case situation consists of an rising variety of California dispensary licenses, hashish costs advancing to a extra typical value, federal legalization sooner or later, and tax aid to some extent. This might all result in mid hundred-million-dollar vary money movement. At $5 per share the inventory is a superb worth for a agency with Glass Home’s potential. Though the inventory is down, I consider that’s due to the overall decline of hashish shares, and never due to SPAC buyers reaping income.

Conclusion

Catalysts for 2022 embody doubling retail dispensaries, tripling cultivation capability, doubtless aid from a really burdensome hashish tax surroundings in California, and potential for wholesale value restoration. Longer-term catalysts look very comparable. Glass Home will look to proceed increasing its retail license portfolio and construct out the rest of its 5.5 million sq. foot greenhouse. Seize this seed earlier than it blossoms.