Marco VDM/E+ by way of Getty Photographs

Funding Thesis

Aurora Hashish (ACB) can’t decide to a set course. As the prices of its failures mount, it’s tough to see how administration will reclaim the corporate’s former glory in an oversaturated hashish {industry}.

Trade Overview

For years, SA writers, traders, and Reddit-lurkers alike have bolstered the marijuana {industry} as a modern-day gold rush, citing CAGR projections to the tune of 20-30% and the regular rollback of legal guidelines banning hashish worldwide. Within the curiosity of brevity, I’ll skip the pitch you’ve all heard earlier than. The underside line is that the hashish enterprise is certainly promising, however after years of hype it’s not the toddler {industry} it was in 2018.

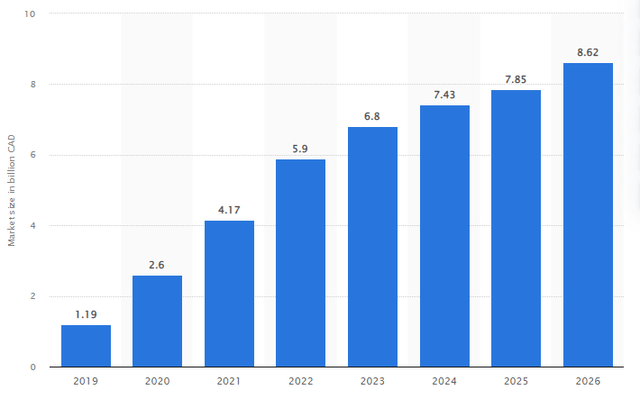

Measurement of Authorized Leisure Canadian Hashish Market (in billions CAD) (Statista)

Supply: Statista.com

The above chart illustrates the dimensions of the authorized leisure hashish market in Canada, together with market measurement projections from 2022 onward. Proper now, the Canadian market is having fun with the tail-end of the increase that was ignited by Canada’s federal legalization in 2018. Whereas there may be nonetheless loads of development available, the {industry} has reached a stage of maturity that may start to weed out underperforming firms.

With a staggering 776 licensed producers in enterprise, market oversaturation has imposed pricing pressures which can be slowly bleeding out companies. America will nonetheless probably legalize on the federal stage, however that might be years away as the one progress has come within the type of payments that by no means achieve any actual traction. Internationally, hashish nonetheless faces legal guidelines and purple tape that limits shoppers to medical use solely. Because the market continues to mature, errors will change into extra expensive, and Aurora isn’t any stranger to blunders.

A Transient Historical past of Aurora’s Follies

When Canada legalized marijuana in 2018, ACB took headlines by storm because it made a number of offers to broaden manufacturing capabilities. Simply months after legalization, ACB had already secured 20% of the Canadian retail market. With 15 international manufacturing amenities at its top, the corporate had been on tempo to pump out 600,000 annual kilos of hashish. Traders flocked to ACB, inflating its share value as much as $128.27 at its top.

Because the years went on, it grew to become clear that administration had considerably overestimated rapid market development charges following legalization. Their give attention to premium leisure Canadian merchandise failed as shoppers in the end most well-liked low cost choices and decrease costs. Aurora started to shutter and promote manufacturing amenities to chop bills as their CEO Terry Booth stepped down in early 2020. The corporate claimed it could hand over on worldwide operations to give attention to the Canadian and American markets.

Present Monetary State

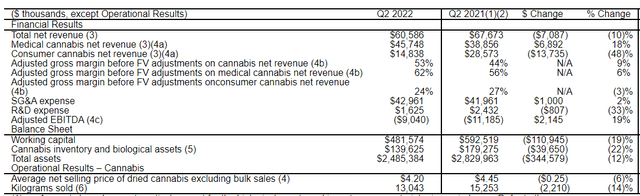

With a closing inventory value of $4.70 on Feb 16, ACB has fallen removed from the heights of its glory days. In its latest FY22 Q2 report, the corporate reported a ten% drop in complete income in comparison with its quarterly outcomes a yr prior, due to the Canadian pricing struggle. Over the identical interval, its web income from shopper hashish fell by 48% whereas its medical hashish web income elevated by 18%. The corporate has managed to chop its working bills persistently during the last three quarters, placing it on monitor of its ‘enterprise transformation plan’.

Consolidated FY22 Q2 revenue assertion (Nasdaq)

Supply: Nasdaq.com

So far as its stability sheet goes, the corporate has gathered $263.25 million USD in money, giving it a positive stability sheet for the {industry}. Nevertheless, its historical past of overpaying for its many acquisitions has left $700 million USD of goodwill on its stability sheet, making up 35.7% of its complete belongings. As Aurora continues to restructure, its straightforward to surprise if the corporate will have the ability to leverage the total worth of its goodwill beneath a altering enterprise mannequin. If not, the corporate will probably be pressured to start adjusting its goodwill sooner or later, slicing into its web revenue.

An Unfocused Technique (Nonetheless)

Whereas administration seems to be slowly turning financials round, it appears they’re nonetheless having a tough time focusing their technique and adjusting to shopper preferences. ACB is clearly bleeding cash within the Canadian leisure market and has expressed their issues over pricing pressures as they declare they’re specializing in the medical {industry} the place they’ve a aggressive benefit. But of their latest earnings name, they introduced their plans to roll out a brand new leisure line of premium hashish. The Canadian leisure market is already slashing into their income as their medical and worldwide companies thrive. Why proceed to pour cash into such an oversupplied market that has clearly expressed its disinterest in premium merchandise?

This isn’t the primary time ACB has tried and didn’t shift its technique. Recall that the corporate said it was going to ‘hand over’ on worldwide markets in 2020; immediately these worldwide markets have change into considered one of their few markers of success. Now administration claims they’re going to shift to at least one course whereas maintaining one foot in a dropping courtroom. The priority right here is that whereas the marijuana {industry} continues to mature, ACB will proceed to make multi-million greenback blunders, overpaying for this acquisition or burning cash into that failing product line, and proceed to slide till its competitors leaves them within the mud.

Alternatives To Capitalize On

Not all information is dangerous information for ACB. Recently Aurora has skilled success in each the medicinal and worldwide markets. Even when its administration can unite beneath a method targeted on these fronts, nevertheless, success won’t come so simply. The medical market has a decrease ceiling than the leisure market long-term. At the moment, 1% of Canadians use marijuana medicinally. If ACB is to capitalize on its medicinal benefit, they must launch an academic marketing campaign to persuade Canadians of the advantages of medical marijuana or stay restricted to a comparatively small shopper base in comparison with the leisure market.

ACB has additionally succeeded internationally, as their FY22 Q2 report claimed the corporate noticed a 50% gross sales development in each the U.Okay. and Australian markets that quarter. The corporate is presently energetic in 11 international locations. Aurora claims that its presence in these international locations places it in a wonderful place for growth as soon as these international locations open recreationally, however we’ve already seen how sluggish federal legalization may be by way of america. Aurora can actually squeeze out some earnings from its medicinal enterprise in these international locations, however whether it is holding its breath for federal legalizations, the corporate will go out earlier than its desires come true.

Conclusion

ACB could also be on monitor with its enterprise transformation plan, however it doesn’t appear to be administration have modified their indecisive methods. Aurora survived the rapid results of their final blunders by means of a CEO swap and reverse inventory cut up. If administration can’t align their technique beneath their profitable enterprise segments, their competitors will undoubtedly start to steal away market share. That’s, if Aurora can survive one other string of multi-million greenback errors in any respect.

I fee ACB as impartial for now, given its promising medical and worldwide prospects. I personally don’t imagine the present administration has the flexibility to capitalize on these alternatives as they dig out of their final gap, however it’s value monitoring their quarterly reviews to see if they’re really capable of flip issues round sooner or later. Maybe sooner or later ACB will discover a technique that works and capitalize on its strengths. If that day ought to come, traders can purchase in whereas they’ll earlier than the following industry-hype wave breaks.