Ryland Zweifel/iStock by way of Getty Photographs

For buyers with conviction and a very long time horizon, Glass Home Manufacturers (OTC:GLASF) is not only one of the vital attention-grabbing hashish firms, however one of the vital formidable companies in America. They’re California’s best hope.

This can be a story a few struggling state system and a standout operator. California hashish is overtaxed, there aren’t sufficient shops, and the normal market remains to be thriving. Solely the strongest will survive. For buyers with conviction and a very long time horizon, Glass Home Manufacturers is not only one of the vital attention-grabbing hashish firms, however one of the vital formidable companies in America.

That is the primary of a two-part sequence. Right here we’ll discover the fundamentals, and for half two I’m visiting the greenhouses, touring The Farmacy retail retailer, and reviewing Glass Home Farms flower.

Historical past

Glass Home Manufacturers (known as “Glass Home”) turned public on July 5, 2021, by way of a SPAC transaction with Mercer Park Acquisition Corp. Mercer Park is backed by finance veteran and AYR Wellness Chairman, Chief Government Officer, and Company Secretary,Jonathan Sandelman. The automobile was created in 2019 with the aim of buying and rising hashish manufacturers. Mercer Park sat dormant, looking for an acquisition goal till Glass Home entered the equation.

The deal included the entire Glass Home manufacturers on the time: Glass Home Farms, Forbidden Flower, and Mama Sue for a price of $325 million. As well as, they paid $24 million to Factor 7 for 17 retail dispensary licenses, and $219 million to amass the Southern California greenhouse. This brings the full transaction worth to $567 million.

The items of the puzzle are clear: a powerful group already rising flower at smaller, however important measurement. A large greenhouse to extend scale and scale back prices. Plus, an extra 17 retail licenses to attain vertical integration and assist promote the greenhouse output.

Management

Kyle Kazan and Graham Farrar lead the Glass Home cost. Graham serves as Co-founder, President & Board Director. He beforehand co-founded software program.com and parlayed that into one other exit with SONOS. Entrepreneurs are fortunate to convey one firm public, Graham is in his 40s and on his third.

To kick off this undertaking, we met for espresso on a sunny day in Santa Barbara. He’s charismatic, passionate, and was carrying his signature hat. The data he shared is unfold all through this overview, however there are a pair qualitative takeaways.

Graham’s intentions are proper. Glass Home is dedicated to rising at scale however in an ESG-friendly method. They wish to do the best good, with the least hurt. Our youngsters are comparable ages, and we talked about being accountable hashish customers and educating the following era.

He is extremely motivated, but additionally a correct stoner: I don’t know of one other MSO chief that may roll a joint and take a dab. Graham is aware of high quality and understands what California customers anticipate.

Graham is complemented by Co-founder, Chairman & CEO Kyle Kazan. He’s a super-successful real-estate investor and runs the Lengthy Seaside workplace. Kyle frolicked as a special-ed instructor and a law-enforcement officer. The latter gave him a first-hand take a look at how the Warfare on Medication was failing and the way hashish was being misportrayed because the villain, quite than an ally.

Kyle and his buyers purchased the primary 150,000 sq. foot greenhouse, and later the 350,000 square-foot facility down the highway. He’s additionally accountable for securing the actual property in Santa Barbara the place The Farmacy is located.

Graham and Kyle are two of the highest abilities within the hashish area and one among Glass Home’s strongest attributes.

Footprint

Glass Home is a single-state operator targeted on California: the world’s largest hashish market. California is residence to extra individuals than Canada, by itself could be the world’s fifth largest financial system and the chief in hashish tradition. To paraphrase Graham, “your favourite tequila comes from Mexico, the highest champagne from France, and the perfect hashish comes from California.”

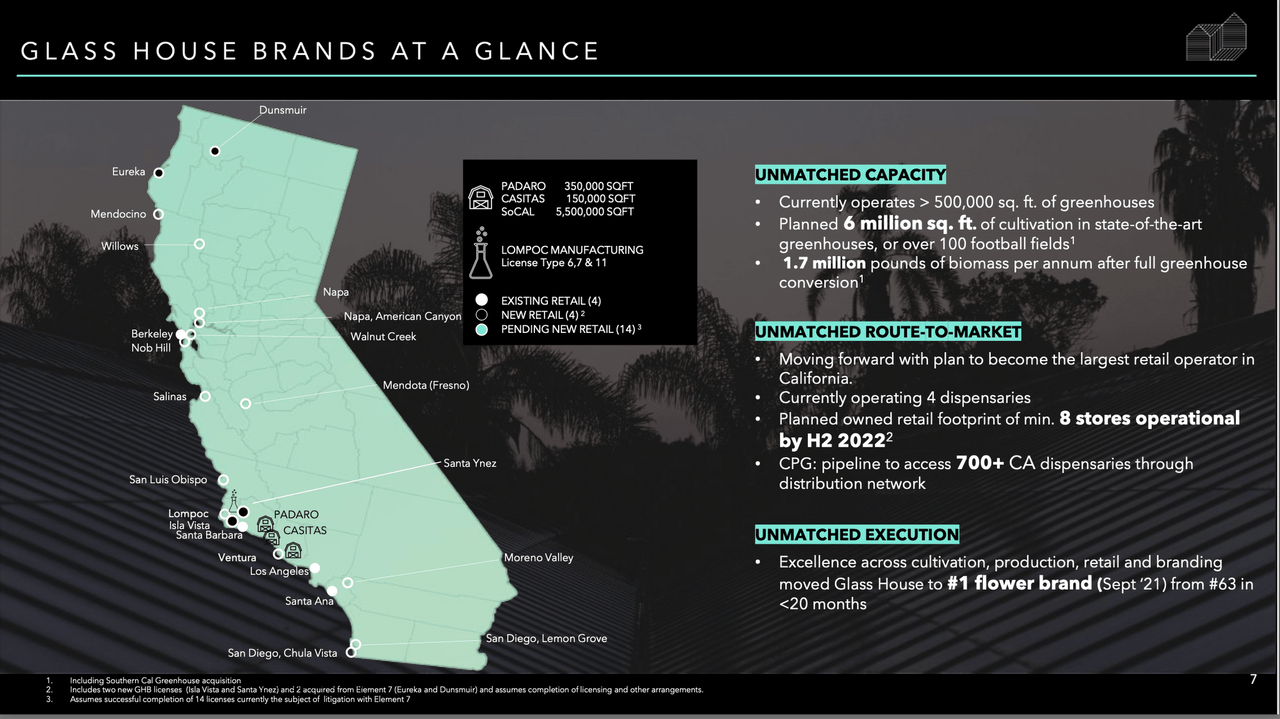

Glass Home November 2021 Investor Presentation

Retail Presence

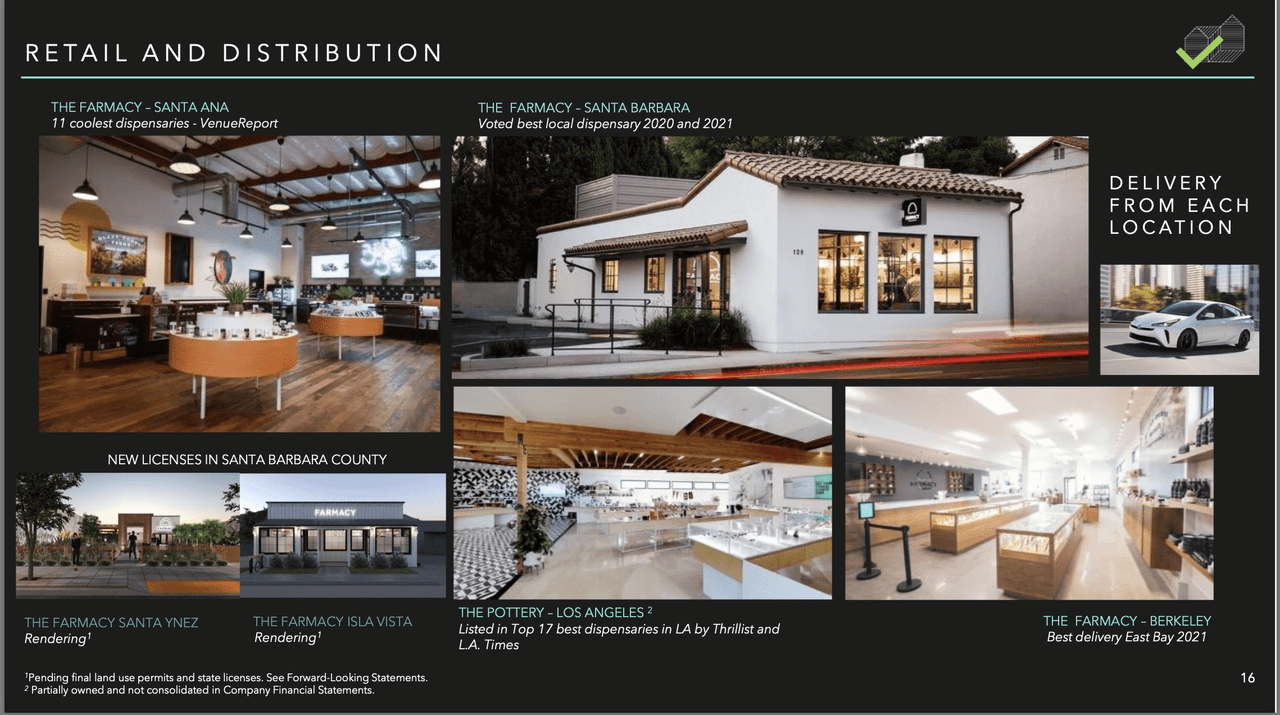

The agency presently operates 4 retail areas: The Farmacy has shops in Santa Barbara, Santa Ana, and Berkeley, and there may be one The Pottery dispensary in Los Angeles. Whereas California is an open-license state, it’s as much as every metropolis to determine whether or not they need hashish, and in that case, how a lot. I wrote about this within the article “Why Limited Licenses Matter.”

Glass Home excels at profitable restricted licenses in key areas. Santa Barbara had a heated competitors for 3 store-front licenses. Glass Home received one (together with Jushi and Coastal) and opened a ravishing retailer in a main a part of city. The Pottery in LA is an award-winning retailer with a ravishing open structure. The Farmacy in Berkeley is in an prosperous metropolis with one of many greatest universities. Santa Ana is their different key location, simply south of LA.

Glass Home November 2021 Investor Presentation

Extra shops are on the horizon, and I’m significantly excited concerning the new location in Isla Vista. This school city is residence to over 30,000 UCSB college students. I graduated from UCSB and may attest that hashish use is rampant. The Farmacy Isla Vista would be the solely dispensary on the town.

The Factor 7 Deal

When Glass Home went public, $24,000,000 was paid in inventory to Factor 7 for 17 California retail licenses. Having extra shops all the time helps, however having the ability to characteristic in-house manufacturers is a good larger enhance. Glass Home shops promote 15x extra Glass Home Farms flower versus different manufacturers.

To this point, Factor 7 has totally transferred simply three of the 17 retail licenses. Consequently, on November 4th Glass Home filed suit in opposition to Factor 7 in Los Angeles Superior Court docket. Not promptly getting the licenses is a setback, however not crippling. Had the SoCal greenhouse fallen by way of, it will have actually harm.

Manufacturing

Glass Home is vertically built-in — the retail is paired with develop and manufacturing amenities. The 20,000 square-foot manufacturing facility is in Lompoc, an hour north of Santa Barbara. This complicated produces extracts, pre rolls and serves as a distribution hub. The output will be offered in Glass Home retail shops and offered to different non-Glass Home shops. I frequently see Glass Home merchandise featured in different dispensaries.

Develop Amenities

Glass Home makes a speciality of greenhouse-grown flower. Greenhouse is the perfect of each worlds: it’s extra inexpensive than indoor, however higher high quality than outside. After I ran a California collective, greenhouse out-sold indoor 3:1. I want the terpene profile of sun-grown hashish.

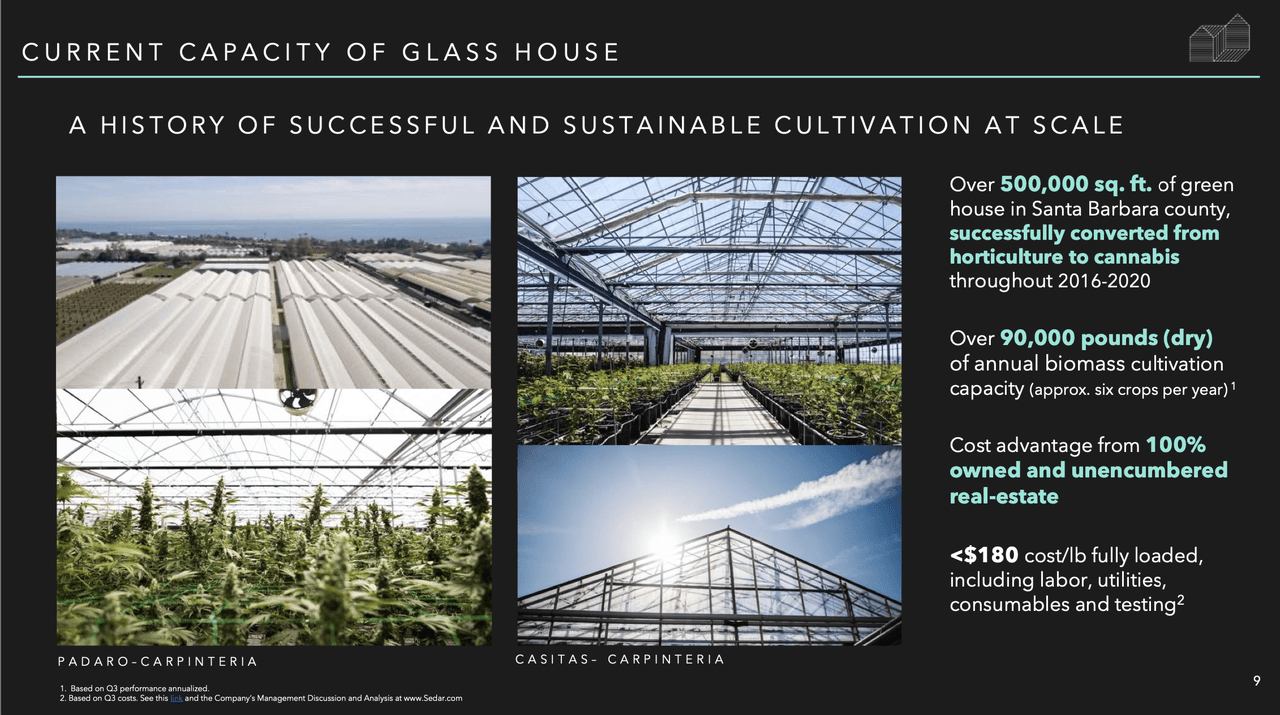

Each operational greenhouses are situated in Carpinteria, a beachside metropolis 20-minutes south of Santa Barbara. Carpinteria is flush with greenhouses, initially from Dutch flower growers. The flower enterprise moved to Central America and hashish has taken over.

Glass Home has two farms right here spanning 500,000 square-feet of mixed cultivation, able to producing 90,000 kilos of dry biomass per yr. They personal these two greenhouses; no sale leasebacks or different monetary trickery.

Glass Home November 2021 Investor Presentation

One of many major causes the flower is so good is the climate. Santa Barbara is among the few Mediterranean climates on the earth, distinguished by the tight band between winter and summer season temperatures. Add within the ocean breezes, and Glass Home’s farms are ideally positioned.

The opposite edge lies in know-how. Dutch greenhouses implement wonderful local weather controls, permitting perfect circumstances for the vegetation. I’ll elaborate within the second a part of this sequence.

The SoCal Greenhouse

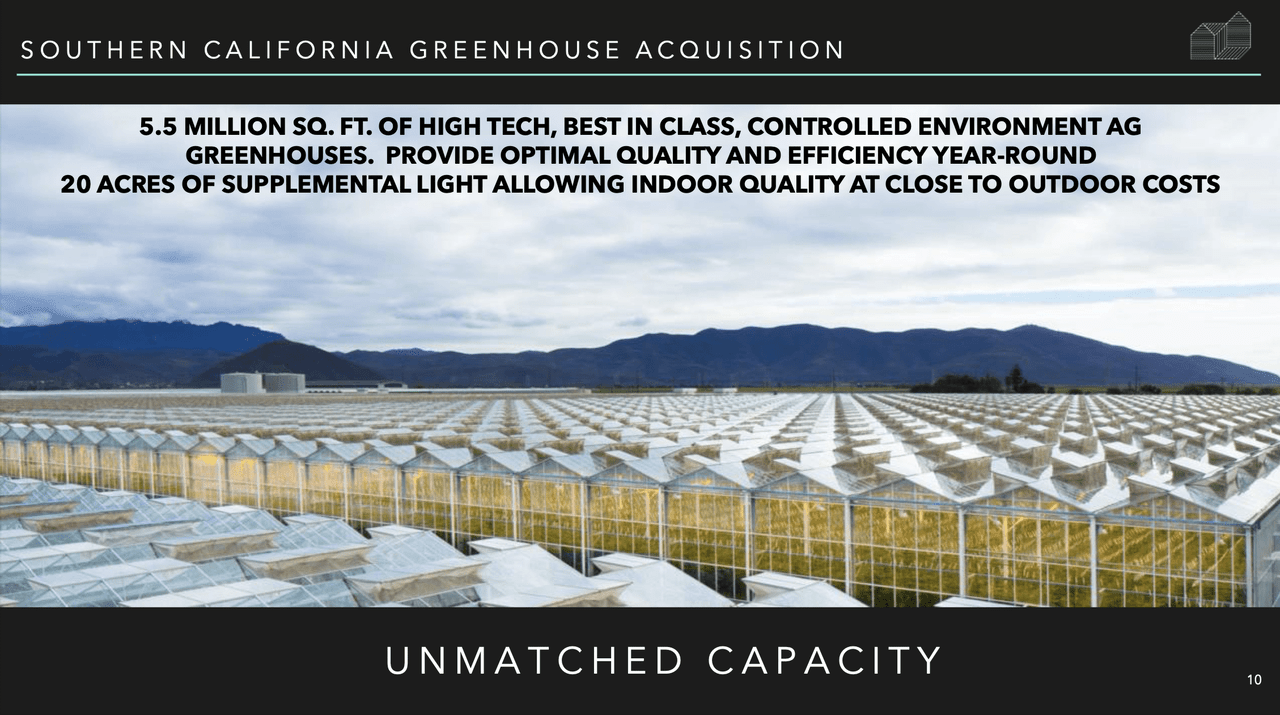

The Carpinteria greenhouses are huge, however their new 160-acre Southern California facility is 6x larger than the 2 current farms mixed. Beforehand, this monstrosity had been used to develop tomatoes. As soon as transformed, it will likely be the most important cannabis-growing greenhouse in the USA and second-largest on the earth.

The primary two phases shall be prepared for planting within the second half of 2022. Based mostly on current Glass Home yields, this can add 1.7 million dry kilos per yr of manufacturing. The extra area shall be completed in 2023/2024 and increase complete cultivation to three,800,000 sq. toes. For perspective, that is larger than Amazon’s largest warehouse.

Glass Home November 2021 Investor Presentation

Value Benefit

As scale will increase, prices lower, and margins increase. Within the present Carpinteria amenities, it prices Glass Home $179 (pre-tax) to supply one pound of flower. For comparability, I lately toured an indoor facility in California and their price is $1,200/pound.

When the SoCal facility comes on-line, prices drop to $128/pound, a 28% discount. Full-sun, large-scale outside will battle to compete with these prices, and outside doesn’t command the identical value as a superb greenhouse.

Merchandise

Glass Home Farms is the best-selling flower in California. Most Glass Home Farms flower is offered in 1/8 jars for round $35. For comparability, top-shelf indoor 1/8ths are round $60, whereas outside runs about half that price. Greenhouse flower hits a center value level that works for a variety of customers.

Glass Home Farms

Pre rolls are a rising section and Glass Home has one-gram singles and half-gram 5 packs. These smaller joints are nice for solo classes. The Farmacy in Santa Barbara sells 28 completely different pre rolls.

Glass Home Manufacturers additionally presents two celebrity-inspired traces. The Bella Thorne sequence touts effect-driven merchandise like “hype up”, “activate” and “relax”. Mama Sue are the CBD tinctures. CBD sells nicely with newer customers which can be intimated by THC, or with medical sufferers that profit from the ache and anxiety-relieving qualities.

Lastly, Discipline is the extracts. The lineup is totally dwell — derived from recent/frozen flowers. This terpene-rich materials produces dwell resin, which is extracted utilizing a solvent like butane that’s purged later within the course of. Discipline additionally makes dwell rosin, which makes use of the identical materials as dwell resin, however employs a solvent-less extraction course of. Stay rosin is the top-shelf dabs and may price over $100/gram.

Glass Home isn’t presently producing cured resins. As a substitute, they promote their trim. I believe this can change and we are going to see a extra inexpensive line of extracts spanning shatter, badder, and finally distillate to be used in pens. Plus, pun meant, they might use the trim for edibles.

Plus Edibles Acquisition

On December 20, 2021, Glass Home introduced the acquisition of Plus Merchandise, a number one edibles firm. The deal was valued at $25.6 million and was financed by way of a mixture of convertible debt, fairness, and extra performance-based consideration.

Herb.co

Plus operates in California and Nevada, and is greatest recognized for its sleep-inducing line and strain-specific merchandise. They’re the number-four promoting edibles model in California. Glass Home can start instantly placing Plus of their retail areas and push them by way of their distribution community to an extra 700 shops. Lack of distribution was one of many greatest challenges up to now for Plus.

The addition of Plus offers Glass Home the number-one flower model and number-four promoting edibles model on the earth’s largest hashish market.

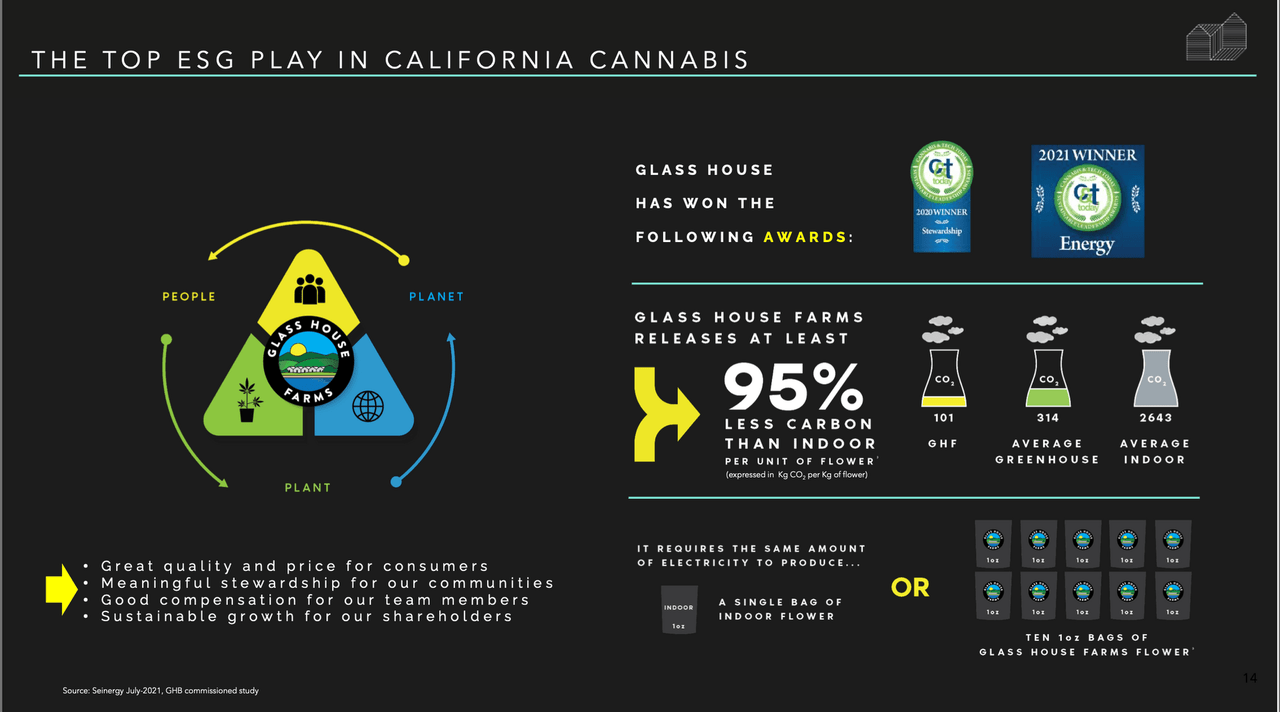

Environmentally Acutely aware Hashish

ESG refers to environmental, social, and company governance. This stylish acronym is a criterion for measuring the moral affect and sustainability of an organization. After I sat down with Graham, I might inform this was one thing near his coronary heart.

Rising hashish will be environmentally taxing — indoor consumes as much as 2,000 watts of electrical energy per sq. meter, about 40x what’s required to develop lettuce. It’s estimated that rising hashish accounts for greater than 1% of US electrical energy consumption.

Glass Home makes use of daylight to develop their flower and the result’s 95% much less carbon than indoor. They estimate that the identical quantity of electrical energy used to supply one ounce of indoor flower can develop ten ounces of Glass Home Farms flower (supply: Seinergy July-2021, GHB commissioned examine). The price financial savings are monumental, and the environmental profit is even larger.

Glass Home November 2021 Investor Presentation

Glass Home can also be a superb steward in the neighborhood. I frequently see them on the native meals financial institution, giving again to varsities, and attempting to make Santa Barbara a greater place. The group’s ethics and intentions deserve recognition.

California Challenges

The near-term query is whether or not Glass Home can overcome the challenges plaguing California. The taxes are too excessive, the laws are excessively burdensome, and there are usually not sufficient retail shops to promote the flood of flower in the marketplace.

Under are the taxes on a $200 buy at The Pottery dispensary in Los Angeles:

- $230 after 15% excise tax

- $253 after native hashish enterprise tax of 10%

- $277.04 after 9.5% gross sales tax is utilized

This doesn’t embody the hashish cultivation tax of $161 per pound that’s utilized earlier within the provide chain. A bill to eradicate the cultivation tax efficient July 1st, 2022 was lately launched. This may profit all growers, particularly low-cost producers like Glass Home, however doesn’t affect the egregious retail taxes.

Lack of retail doorways is the opposite main downside in California. Large quantities of flower are being grown, and there aren’t sufficient locations to promote it. It’s so dangerous that some farms destroyed their crops this fall, quite than paying the cultivation tax and attempting to show a revenue. Others discover methods to maneuver stock off the books and divert product to the normal market.

If the cultivation tax is eradicated, cities cut back on native taxes, and extra retail doorways open, the California market will enhance and all boats will rise. Shortly, it may well turn into way more worthwhile. Whereas it seems tides are altering, I’ve discovered to have low expectations from politicians.

The broader California market is the largest danger to Glass Home. When California accelerates, Glass Home is in a superb place. There’s a distinct risk this all takes longer than anticipated. On this setting I anticipate Glass Home to outperform friends within the state, however lag limited-license East Coast operators.

For a deeper evaluation of the California market, try The Cannabis Investing Podcast with Hirsh Jain and Emily Paxhia.

Valuation

Glass Home is a progress story and is priced accordingly. Earnings are additionally very delicate to wholesale flower costs. When your price of manufacturing is round $180/pound (pre tax), margins change drastically when flower goes from $500 to $750 a pound, or vice versa. Within the second half of 2021 California flower costs dropped 50%, crushing Glass Home’s margins and earnings.

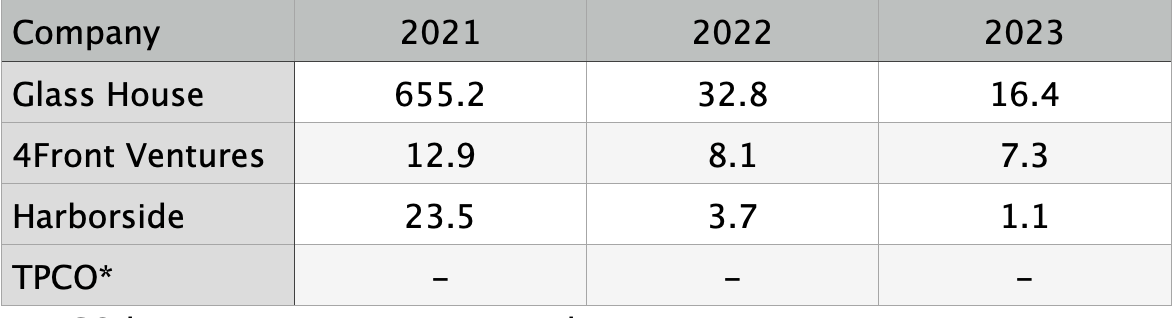

Under is a comparability of enterprise worth to EBITDA for 4 California operators.

Writer

In early-stage progress companies, near-term valuations are much less necessary. Glass Home is a guess on the administration group, the California market, and a few likelihood that we see interstate commerce.

The Instersate Name Possibility

The standard market tells us your complete nation needs California hashish — a large quantity is shipped and offered in different states. Unlawful operators in New York characteristic California hashish on the highest shelf

If interstate commerce opens, Glass Home shall be an enormous exporter of hashish. This can assist take up the total capability of the greenhouses, and at doubtlessly greater costs. Within the conventional market, California hashish offered in Texas instructions a 50% premium over what it may be offered for domestically. The potential for greater costs with low manufacturing prices is a tough to quantify name choice.

Transferring Ahead

Glass Home is among the most compelling hashish tales. They’re vertically built-in with greenhouses, manufacturing, and retail throughout California. Glass Home Farms is the best-selling flower model in California, and the addition of Plus edibles offers them the number-four edibles providing. Filling out the extracts and including vape cartridges will spherical out the lineup.

Traders have to determine if they’re prepared to guess on California. It’s ultra-competitive, extremely taxed, and doesn’t have sufficient shops to promote all of the flower being grown. If the state eliminates the cultivation tax, cities reduce native taxes, and extra doorways open, this might be one of many hottest markets. However, these are three huge ifs.

From a portfolio-construction perspective, Glass Home pairs nicely with Verano. Glass Home makes a speciality of inexpensive, greenhouse-grown flower, and operates solely in California. Verano focuses on premium merchandise, indoor flower, and is in 17 states, however not California. Collectively, they offer you diversification throughout merchandise, value factors, administration groups, and geographies.

I like to recommend Glass Home to buyers with a very long time horizon, sturdy conviction, and optimism round political progress. They’re California’s best hope.

Disclosure: On the time of publication (February 22, 2022) I used to be not invested in Glass Home and I used to be not compensated for scripting this report.

Editor’s Be aware: The abstract bullets for this text had been chosen by Searching for Alpha editors.